Market | High Value-Added Fashion: Bangladesh’s Garment Industry is Growing Due to Suits

- FninkJet

Bangladesh’s garment industry has been known from the very beginning for producing basic knitted sweaters, which are often sold at very low prices at foreign retailers and brands. Today, clothing manufacturers are willing to produce high-end clothing. Along these lines, some apparel makers turned to suit manufacturing – as the high profit margins in the suit market attracted the attention of entrepreneurs.

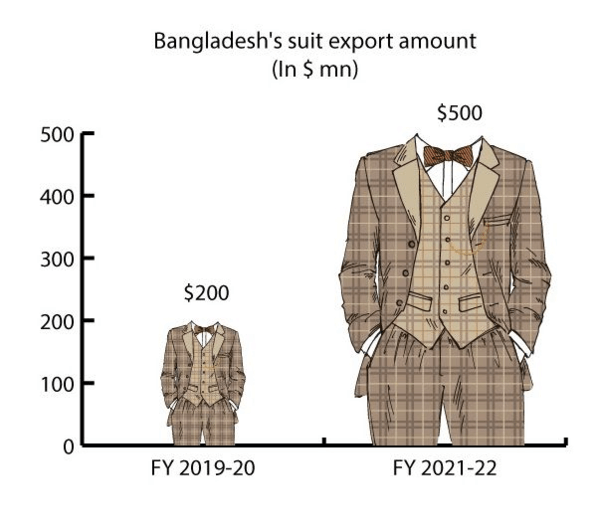

Bangladesh is now making a huge leap in mass-producing suits, which are sold globally and exporting $500 million a year.

Currently, Bangladesh meets 12-15% of the global demand for suits, formal jackets and sports jackets. It’s not just for export, Bangladesh has great potential value in the local fashion market, generating more revenue every financial year.

Bangladesh is currently one of the top five exporters of men’s and women’s suits, tops and trousers, along with China, the European Union, Vietnam and Turkey, with a total of 13 suit factories exporting suits worth US$500 million.

Bangladeshi suit exports (million USD)

Bangladeshi suit exports (million USD)

Outerwear, including jackets, is $12 to $14 in profit, while suits are $25 to $28, according to industry experts. A low-end suit costs between $99 and $150, a mid-range suit costs between $150 and $300, and a high-end suit costs around $300 and up.

Foreign buyers choose to source suits in Bangladesh

Suits made in Bangladesh are attracting buyers from across the globe, with major buyers such as H&M, M&S, C&A, Zara and Jos A Bank sourcing from the country.

In an interview with Textile Today, a British national representative and a prominent retailer said suit manufacturing in Bangladesh definitely has great prospects. She said the country had become the largest source of suits for British brands.

Profits of suits of various grades

Profits of suits of various grades

“While Bangladesh does not have many suit manufacturing factories with added value, we are working with existing factories. We work a little differently with factories. For example, as people in many countries start to go out, the trend of buying suits grows, We started doing semi-casual clothing.”

She added: “The main challenge here is that most suit manufacturers in Bangladesh are importing fabrics from China. In addition to the existing rising freight rates, Chinese factories are also facing a severe power crisis, which has resulted in extended lead times for fabrics.”

“This also opens a door for Bangladeshi suit manufacturers to develop end-of-line industries and produce suit fabrics,” the representative said.

Saifur Rahman Farhad, Marketing Director at Interlink Dresses, highlighted Bangladesh’s shift in clothing production capacity. “Because we’re known for making basic garments, four or five years ago, when we marketed suits to buyers, they were skeptical of our ability,” he said. “They usually source suits from countries like China, Vietnam, etc.”

“However, when manufacturing prices in China suddenly rose and production in Vietnam was hampered during the Covid-19 pandemic, retailers had no sourcing options. At that time, when we offered them suits, they immediately ordered from us. “

Saifur Rahman also expressed the urgent need for Bangladeshi suits from buyers, adding: “Usually we receive orders 120 days in advance. Now buyers are asking for 8 months in advance and requesting our service. Considering the usual situation Next, the delivery time in Bangladesh is 120 days, buyers want to get out of this predicament, it is best to place an order first, first come first served, to ensure early production. Due to the favorable price, the capacity of most suit manufacturing factories is booked It’s July-September. Now buyers can accept our prices within 5 to 7 days. As a manufacturer, we are really happy to see this situation. Most importantly, a large number of American buyers are coming back.”

Challenges in Suit Manufacturing

Despite the enormous opportunity in the suit industry, manufacturers have been facing several issues that have hindered the development of the field.

Abdullah Al Mamun, the vice-chairman of Bangladesh Textile Mills Association (BTMA), said of the ability to supply suit fabrics: “Despite the high demand, the supply capacity of local textile mills is obviously insufficient due to the large investment required. Therefore, manufacturing Manufacturers mainly import fabrics from China and South Korea.” Mamun added: “Although some factories have started small-scale production, Bangladesh still has a long way to go.”

Saifur Rahman Farhad, director of marketing at Interlink Dresses, said: “The suit industry is currently in a tight situation with a labor shortage coupled with the restrictions on letters of credit.” He said, “With high worker turnover in the suit industry, suit factories are lacking Skilled workers. The industry has laid off a large number of workers during the Covid-19 pandemic. A large percentage of these workers have moved into other industries and never came back.”

Labour shortages have also forced entrepreneurs to shut down some profit-damaging production lines at factories, he added. Although orders have increased and many people have applied for loans during the epidemic, they cannot repay the loans due to the shutdown of production lines.

“In addition to this, suit factories are also facing problems from banks. Due to the sudden influx of orders, factories are exceeding the limit of letters of credit set by banks, which is hindering the development of the suit industry. We need urgent government support to extend the repayment time of the loan. It takes at least 5 years, not 3 years now. With a longer repayment period, factories will be able to repay the loan while retaining workers so that the apparel industry has a better chance of survival.”

Share:

Categories

More Posts

What are the Reasons for the Color Deviation of UV Flatbed Printers?

What is the Difference Between LED Flatbed Printer and Traditional Inkjet Printing

The Difference Between Printhead Cleaning and Pump Ink of Flatbed Printing Machine

Subscribe To Our Newsletter

No spam, notifications only about new products, updates.